Tax Tips & FAQs

Everything you need to know (and maybe were afraid to ask).

#1 Start Early:

Don’t wait until the last minute to gather your documents or begin your return. Starting early gives you time to catch mistakes and avoid the stress of a looming deadline.

Get the Refund You Deserve—File Your Taxes with Confidence.

Give us a little info and get started on the path to peace of mind.

#2 Team Up with a Tax Pro:

Feeling overwhelmed by all those forms, or just want to save yourself some time? A tax preparer can be your go-to expert for sorting through the details and filing your taxes for you. Whether your finances are getting more complicated or you just want peace of mind, teaming up with a tax pro can make the whole process smoother and stress-free. They’re there to answer your questions, explain the tricky stuff, and handle the heavy lifting for you!

LBL Tax FAQs

Do I need to file a tax return?

Whether you need to file a tax return depends on:

-

Your income, tax filing status, and age.

-

Whether someone else can claim you as a tax dependent.

-

If you had income tax withheld from your paychecks or made estimated tax payments.

Why should I file taxes if I didn’t make much money?

Even if your income is low, filing a tax return might qualify you for tax breaks, such as:

-

Earned Income Tax Credit (EITC): A refundable credit for lower-income taxpayers.

-

Child Tax Credit: A partially refundable credit for dependents under 17.

When are taxes due?

-

Federal income tax deadline: April 15, 2026.

-

Requesting an extension: If you file for an extension by April 15, your new deadline is October 15, 2026.

-

State tax deadlines: Usually the same as the federal deadline, but some exceptions exist.

When can I file my 2025 taxes?

The IRS typically begins accepting tax returns in early February 2026. Stay tuned for their official announcement.

What happens if I don’t file my taxes?

-

If you owe taxes and don’t file, the IRS will impose penalties, fees, and interest.

-

If you’re due a refund, you won’t face penalties, but you must still file if required.

How is my tax owed calculated?

The government calculates your taxes using:

-

Tax brackets: Higher incomes are taxed at higher rates.

-

Federal and state taxes: State income taxes vary by location and residency status.

What are my options for filing taxes?

You can file taxes in three main ways:

-

Manually: Complete IRS Form 1040 and mail it.

-

Online: Use tax software, such as the IRS Free File program.

-

Hire a tax professional: A tax preparer such as LBL Financial can handle complex finances and save you time.

What information do I need to file taxes?

Gather these key documents:

-

Social Security numbers (for yourself, spouse, and dependents).

-

W-2 and 1099 forms.

-

Proof of retirement contributions, property taxes, mortgage interest, charitable donations, educational expenses, and unreimbursed medical bills.

-

Last year’s federal and state tax returns.

What are the IRS payment options?

The IRS accepts various payment methods, including:

-

Electronic payments

-

Wire transfers

-

Debit/credit cards

-

Checks

-

Cash

What if I can’t pay my taxes in full?

Consider an IRS Payment Plan:

-

Short-term: Pay your balance within a few months.

-

Long-term: Make monthly payments over an extended period.

How can I get my refund faster?

-

File online: Electronic returns are processed faster than paper returns.

-

Use direct deposit: Receive your refund directly into your bank account.

-

Track your refund: Use online tools to monitor the status of your federal and state refunds.

Who do I contact if I haven’t received my refund?

-

If you used an accountant, contact them for assistance.

-

Call the IRS at:

-

Automated system: 800-829-1954

-

Speak with an agent: 800-829-1040

-

-

Contact LBL Financial Services for additional assistance

Kelly’s Tips Continued

#3 Organize Your Documents:

Keep all your tax-related paperwork in one place—W-2s, 1099s, receipts for deductions, and last year’s return. Staying organized makes filing faster and easier.

#4 Know Your Deadlines:

Mark your calendar with important tax deadlines. For most, Federal taxes are due April 15, but some states may have different dates.

#5 Check for Deductions and Credits:

Make sure to take advantage of deductions and credits that apply to you, such as the Child Tax Credit, education expenses, or retirement contributions.

#6 Use Direct Deposit for Refunds:

Keep all your tax-related paperwork in one place—W-2s, 1099s, receipts for deductions, and last year’s return. Staying organized makes filing faster and easier.

#7 Double-Check Your Work:

Before filing, review your return for any errors, especially Social Security numbers, names, and bank account information. Small mistakes can delay your refund.

#8 Consider E-Filing:

Make sure to take advantage of deductions and credits that apply to you, such as the Child Tax Credit, education expenses, or retirement contributions.

#9 Keep a Copy of Your Return:

Save a copy of your completed tax return and all related documents. You’ll need them for next year’s filing or if the IRS has questions.

#10 Ask for Help if Needed:

If you’re feeling stuck or unsure, don’t hesitate to seek help. Tax preparers, online tools, and even IRS resources can guide you through the process.

#11 File for an Extension if Necessary:

If you need more time to complete your return, request an extension by Tax Day to push your filing deadline to October 15. Remember, you’ll still need to pay any taxes owed by April 15.

Hear What Our Clients Have to Say

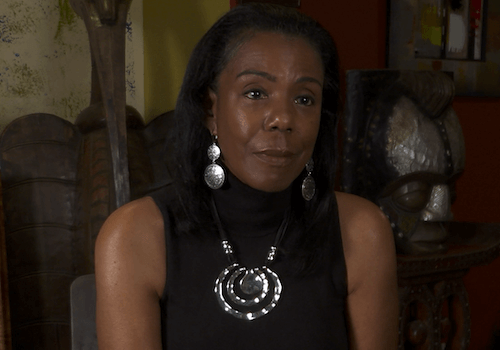

DeeDee Smith

Owner

Soggy Paws Mobile Spa

Kelly actually took the time to research my business not just the finances either but actually what I do so that she can better help me with my finances and make suggestions. She’s been a godsend and keeps me on the straight and narrow.

Dr. Burchell Love

CEO / Owner

Love Learning Center & Mama Lucy’s Catering

I’ve known Kelly for over 15 years and I met Kelly through a business partner of mine years ago. I was very impressed on our first meeting when she was able to tell me about her organization her team and her goals and her understanding of various businesses in the area of Chicago.

Paul Wargaski

Owner

Paul Wargaski Violins

LBL has help me grow this business from a one-man operation in an 800 square-foot studio to triple that amount, including a tripling of our gross income over the years last 10 years.